Each of the three sections is summarized by one number, which is the net cash flows amount. If the summary number is positive, it means that more cash was received than was paid out for that activity during the accounting period. If the summary number is negative, more cash was paid out than was received for that activity during the period.

2.5 Comparative Operating Activities Sections – Statement of Cash Flows

For example, in the Propensity Company example, there was a decrease in cash for the period relating to a simple purchase of new plant assets, in the amount of $60,000. The remainder of this section demonstrates preparation of the statement of cash flows of the company whose financial statements are shown in Figure 16.2, Figure 16.3, and Figure 16.4. Decreases in net cash flow from investing normally occur whenlong-term assets are purchased using cash.

Discarding a Fixed Asset (Breakeven)

Therefore, companies must adjust for the net profits or losses brought from the income statement. Once they do so, companies can move toward the other treatment for selling fixed assets in the cash flow statement. When preparing the operating activities section of the statement of cash flows, increases in current liabilities are added to net income; decreases in current liabilities are deducted from net income.

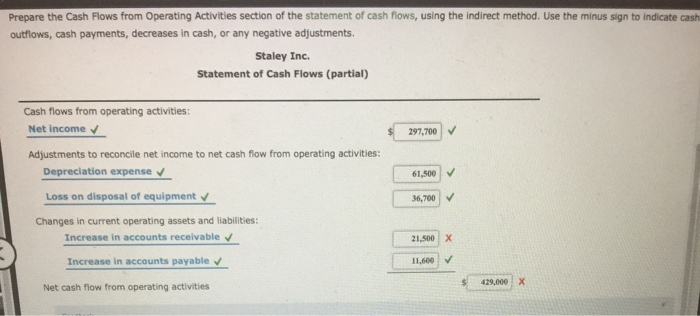

Determining Net Cash Flow from Operating Activities (Indirect

If Example Corporation issues additional shares of its common stock, the amount received will be reported as a positive amount. Note that the combination of the positive and negative amounts in this section add up to a positive 262,000. Hence, it is described as “Net cash provided by operating activities”. If the amounts had added up to a negative amount, the description would be “Net cash used by operating activities”.

Disposal of Assets – Sale of Asset AccountingCoach

Changes in the various current assets and liabilities can be determined from analysis of the company’s comparative balance sheet, which lists the current period and previous period balances for all assets and liabilities. Changes in thevarious current assets and liabilities can be determined fromanalysis of the company’s comparative balance sheet, which liststhe current period and previous period balances for all assets andliabilities. Because the current asset rule states that decreases in current assets are added to net income, $2,000 is added to net income in the operating activities section of the statement of cash flows. This is because cash paid for these expenses was lower than the expenses recognized on the income statement using the accrual basis. Since expenses are $2,000 lower using the cash basis, net income must be increased by $2,000.

The fact that the payable decreased indicates that Propensity paid enough payments during the period to keep up with new charges, and also to pay down on amounts payable from previous periods. Therefore, the company had to have paid more in cash payments than the amounts shown as expense on the Income Statements, which means net cash flow from operating activities is lower than the related net income. The operating activities cash flow is based on the company’s net income, with adjustments for items that affect cash differently than they affect net income. The net income on the Propensity Company income statement for December 31, 2018, is $4,340.

Operating activities are the business activities other than the investing and financial activities. The trade-in allowance of $7,000 plus the cash payment of $20,000 covers $27,000 of the cost. The company must take out a loan for $13,000 to cover the $40,000 cost. Partial-year depreciation to update the truck’s book value loss on sale of equipment cash flow at the time of sale could also result in a gain or break even situation. To record the transaction, debit Accumulated Depreciation for its $28,000 credit balance and credit Truck for its $35,000 debit balance. When a fixed asset that does not have a residual value is not fully depreciated, it does have a book value.

Under the indirect method (also known as the reconciliation method), we convert the net income (or net loss) to the net cash provided (or used) by operating activities during the reporting period. For this purpose, the net operating income (or net loss) figure is taken from the income statement and adjusted for non-cash expenses, timing differences, and non-operating gains or losses. The rest of this article explains how these adjustments are made to the net income (or net loss) to arrive at the net cash flow from operating activities. Since equipment is a noncurrent asset, cash activity related to the disposal of equipment should be included in the investment activities section of the statement of cash flows.

- Secondarily, decreases in accrued revenue accounts indicates that cash was collected in the current period but was recorded as revenue on a previous period’s income statement.

- For Propensity Company, beginning with net income of $4,340, and reflecting adjustments of $9,500, delivers a net cash flow from operating activities of $13,840.

- Since Dells was able to pay cash for the equipment and not take out a loan, how did they pay for it?

- The operating activities section of the statement of cash flows appears first.

- The net cash flows from operating activities adds this essential facet of information to the analysis, by illuminating whether the company’s operating cash sources were adequate to cover their operating cash uses.

- You should consider our materials to be an introduction to selected accounting and bookkeeping topics, and realize that some complexities (including differences between financial statement reporting and income tax reporting) are not presented.

The cash impact is the cash proceedsreceived from the transaction, which is not the same amount as thegain or loss that is reported on the income statement. Gain or lossis computed by subtracting the asset’s net book value from the cashproceeds. Net book value is the asset’s original cost, less anyrelated accumulated depreciation. Propensity Company sold land,which was carried on the balance sheet at a net book value of$10,000, representing the original purchase price of the land, inexchange for a cash payment of $14,800. The data set explainedthese net book value and cash proceeds facts for PropensityCompany.

Financing net cash flow includes cash received and cash paid relating to long-term liabilities and equity. Investing net cash flow includes cash received and cash paid relating to long-term assets. Financing net cash flow includes cash received and cash paidrelating to long-term liabilities and equity. Investing net cash flow includes cash received and cash paidrelating to long-term assets. As you can see from this dialogue, the statement of cash flows is not only a reporting requirement for most companies, it is also a useful tool for analytical and planning purposes. Next, we will discuss how to use cash flow information to assess performance and help in planning for the future.

Notice the increase (or decrease) has already been calculated for you but if not you would take the current year amount – previous year amount. If the current year is more, there is an increase and if the current year is less that is a decrease. Usually, companies acquire fixed assets that contribute to their operations. They keep these assets until the resource reaches the end of its useful life. At this point, the underlying fixed asset may have a salvage value, which companies can get from selling it.